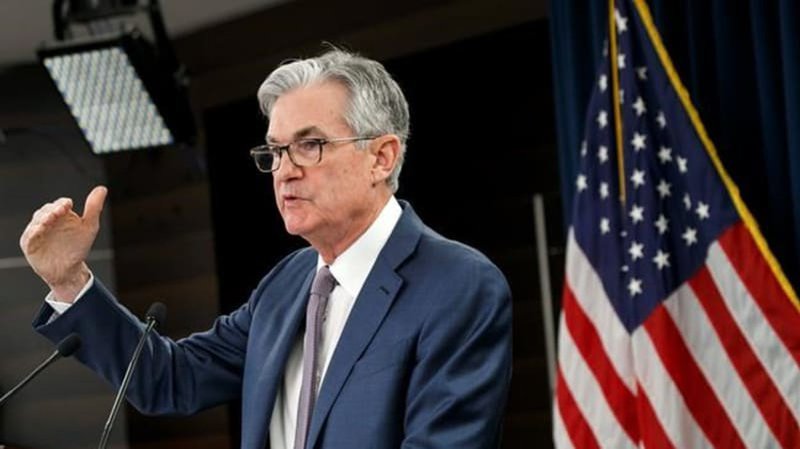

Fed sees dim economic outlook as virus squeezes economy

WASHINGTON — The Federal Reserve is expressing concern that the viral outbreak will act as a drag on the economy and hiring in coming months and that it plans to keep its benchmark short-term interest rate pegged near zero.

In a statement at the end of its policy-making meeting Wednesday, the Fed acknowledged that the economy has rebounded from the depths of March and April, when nearly all states closed down nonessential businesses. But it said the ongoing coronavirus pandemic “will weigh heavily on economic activity, employment and inflation.”

The Fed announced no new policies in its statement. The central bank said it will also continue to buy about $120 billion in Treasury and mortgage bonds each month, which are intended to inject cash into financial markets and spur borrowing and spending.

Economists say the Fed has time to consider its next policy moves because short- and long-term rates remain historically ultra-low and aren’t restraining economic growth. Home sales have picked up after falling sharply in the spring. The housing rebound has been fueled by the lowest loan rates on record, with the average 30-year mortgage dipping below 3% this month for the first time in 50 years.